How to Get Internet without Cable

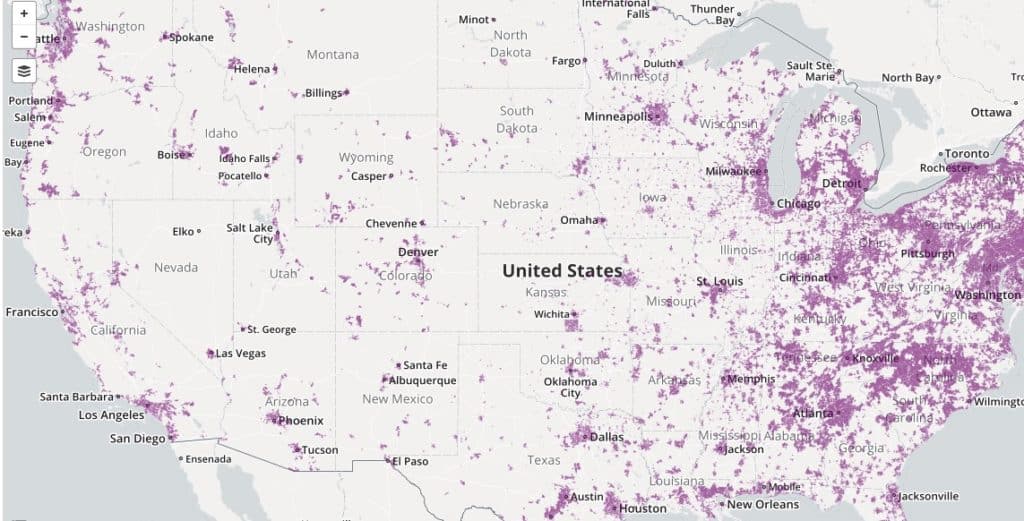

Imagine a dystopia where nobody has DOCSIS (cable) to access the web. For many Americans, this state of affairs is all too real. Refer to the map below to see the swaths across America that lack DOCSIS access to the Internet (as of 2016). Only areas shaded in purple have DOCSIS. In 2018, cable operators (MSOs) provided just 62% of all U.S. Internet connections. Here are five ways to get the Internet without cable.

Source: FCC

Public Domain

Unless one has access to a fiber network (not likely), you’re limited to a choice of inferior Internet service provider (ISP) options in terms of speed, latency and data allowance. Only satellite and dialup ISPs are more or less universally available. These include (in our order of preference):

-

Fixed Wireless (4G LTE)

-

DSL

-

Satellite

-

Mobile Wireless (4G LTE and 3G)

-

Dialup

We’ve mentioned dedicated telco circuits such as T1s before. We omit them from our list here because their cost puts them beyond the reach of most residential customers.

Before we delve into the particulars, watch the Cord Cutting Report’s video “How to Get Internet without Cable” to save money when accessing the web:

1. Fixed Wireless

While historically an option for rural Americans who balked at the cost and problematic performance of satellite Internet service, fixed wireless is fast becoming an option even for those in areas with access to DOCSIS and DSL networks.

Even heavy hitters such as AT&T and Verizon now have fixed LTE wireless service and plan to offer fixed 5G wireless as a “replacement” product for DOCSIS and DSL. Why? One, it’s cheaper to maintain than a traditional copper POTS network and two, both companies now create multimedia content for subscribers (and others) as opposed to their traditional role of bandwidth deliverers.

After its acquisition of Time Warner (now Warner Media, parent to HBO) and AppNexus in 2018, AT&T proclaimed itself as a “modern media company”—a far sexier visual than that of frumpy Ma Bell. Verizon Media is now the umbrella for web content brands like Yahoo!, HuffPost and AOL.

AT&T Fixed Wireless and Verizon LTE Internet

Both AT&T and Verizon are, um, opaque in ‘fessing up to their respective fixed wireless coverage areas. Supposedly, AT&T fixed wireless is available in 19 states covering a population of 2,743,567. But, while both deliver similar data speeds to subscribers, they offer vastly different data “buckets.”

Verizon gives consumers a choice of four niggardly data tiers at an outrageous cost per month:

-

10 GB for $60

-

20 GB for $90

-

30 GB for $120

-

40 GB for $150

“Overage” is billed at $10(!) per GB. Speeds “average” between 5-12 Mbps down and 2-5 Mbps up. A two-year “activation” (read: contract) is required. Verizon also pulls a page from sat ISP Viasat’s marketing playbook by offering new customers “50% more data allowance for their first 2 full billing cycles.” As if that sop will ease consumers’ pocketbook pain when paying these steep prices.

Yes, the IAG is outraged at Verizon’s ridiculous price points and data allowances. Instead of using Big Red’s fixed LTE, we advise consumers to either consider AT&T fixed wireless, a regional Wireless Internet Service Provider (WISP—see below) or HughesNet (see further below) if latency isn’t an issue.

AT&T, by comparison, offers 215 GB at $70/month ($60/month if bundled with DirectTV or AT&T Wireless) with speeds of “at least” 10 Mbps down. Overage charges are $10 per 50 GB of additional data up to a max of $200/month. The Death Star requires subscribers to commit to a 12-month agreement for Internet.

While AT&T’s fixed wireless data allowance pales by comparison to that typically allotted (if at all) by MSOs, it’s still far superior to Verizon’s LTE Internet, which apparently doesn’t realize hundreds of other WISPs also serve America’s hinterland.

Regional WISPs

Indeed, as of mid-2019, 1,582 WISPs delivered Internet access across America, mostly in the nation’s outback although a few offer urban and suburban coverage. While the vast majority of WISPs are “mom-and-pop” outfits covering populations of fewer than 100,000 across one or two states (hundreds of WISPs cover populations of fewer than 3,000), many regional players operate across multiple states with potentially hundreds of thousands of customers.

Largest Midsize WISPs

Rise Broadband—available in 19 states stretching from Indiana to eastern Oregon and California’s southeast desert, it reaches an estimated population of 25,719,363. While they claim to offer data speeds of 1 Gig, don’t expect to receive that kind of broadband at your little house on the prairie. The vast majority of speeds available range from 5-15 Mbps.

King Street Wireless—reaching almost 8 million people in 24 states (2.4% of the USA’s land area) including Midwest, South, New England, Pacific Northwest and Mid-Atlantic regions, they deliver 12 Mbps to subscribers. It offers 3 data tiers of 2 GB, 6 GB and an “unlimited” plan.

Future Technologies—covers an estimated population of 1.1 million in 7 states (mostly western Iowa and eastern Nebraska) and offers residential customers a choice of 6 data speed tiers, the fastest 25 Mbps down and 5 Mbps up.

Speed Connect—serves 12 states (with greatest coverage in Michigan, South Dakota and Idaho) and an estimated population of 463,000. It offers two plans, both with data speeds of 15 Mbps. One plan caps data at 10 GB/month; the other at 100 GB/month.

Choice Wireless—found in 6 states (Nevada, Arizona, California, Utah, Colorado and New Mexico), it covers a population estimated at over 405,000. Choose from four service tiers with no data caps; the fastest is 9 Mbps down and 2 Mbps up. Not to be confused with much smaller Choice Broadband of Odessa, TX, which offers 3 plans with no data caps of 4 Mbps down, 1 up; 10 Mbps down, 2 Mbps up; and 25 Mbps down, 3 Mbps up.

DigitalPath—in the midst of upgrading select service areas with faster data speeds of up to 50 Mbps down and 10 Mbps up, its standard plans offer 10 Mbps down and 2 Mbps up. Data caps are relatively generous. This WISP reaches 282,851 folks, mostly in northern California.

Should I Subscribe to a WISP?

If you, the consumer, are serious about having broadband at home, carefully consider these point-to-point (P2P) Internet providers. Customer service levels vary wildly among WISPs and many have been in business for only a few years. Yet, lots of WISPs don’t impose data caps on their customers (for example, Zoom Broadband in northeast Texas) and you’ll have the satisfaction of supporting local businesses instead of distant corporate shareholders.

Data speeds WISPs offer are as divergent as the number of providers. While speeds have quickened in recent years, you’ll be lucky to receive the FCC definition of broadband (25 Mbps down). Not even AT&T and Verizon claim to offer 25 Mbps fixed wireless speeds.

Remember. wireless lacks the stability of a hardwired Ethernet connection. Data speeds fluctuate with transmission power, atmospheric conditions, signal distances and the portion of the spectrum over which a WISP broadcasts. While most WISPs use licensed spectrum, smaller outfits save money by using unlicensed spectrum, typically in WiFi ranges of 2.4 GHz or 5 GHz. While lower frequencies travel further, higher frequencies offer greater speeds.

For a list of all WISPs in the U.S., see this.

2. DSL

Longtime IAG readers no doubt have noticed our ambivalence toward DSL. While it’s certainly faster than dialup and has improved latency over satellite ISPs, DSL quality of service hinges on the distance between subscriber and the telco DSLAM and the condition of the telco’s plant on which the DSL signal travels.

As noted previously, DSL is a telco product and most all 886 telcos in America regardless of size offer the service. But vast differences separate the DSL services of behemoths like AT&T or Verizon from tiny providers like Pennsylvania’s Palmerton Telephone Company or Maine’s Unitel, both of which cap DSL speeds at 10 Mbps.

While VDSL is available from AT&T and Verizon in urban/suburban areas without fiber, even with this advanced technology distance plays a huge role in data speeds. The table below is calculated based on copper wire with a diameter of 0.4 mm (26 gauge) and widely-deployed ADSL2+ (max theoretical 24 Mbps down) used by many regional telcos:

|

25 Mbps @ 1,000 ft (~300 meters) |

24 Mbps @ 2,000 ft (~600 meters) |

|

23 Mbps @ 3,000 ft (~900 meters) |

22 Mbps @ 4,000 ft (~1.2 kilometers) |

|

21 Mbps @ 5,000 ft (~1.5 kilometers) |

19 Mbps @ 6,000 ft (1.8~ kilometers) |

|

16 Mbps @ 7,000 ft (~ 2.1 kilometers) |

8 Mbps @ 10,000 ft (~3 kilometers) |

|

3 Mbps @ 15,000 ft (~4.5 kilometers) |

1.5 Mbps @ 17,000 ft (~5.2 kilometers) |

Source: Wikipedia

ADSL2+

Look upon the numbers above with askance. Why? There are reasons why AT&T doesn’t sell ADSL2+ at speeds faster than 18 Mbps down and 1 Mbps up and Centurylink caps ADSL2+ at 10 Mbps down and 768 Kbps up.

ADSL2+ is hypersensitive to electrical interference caused by thunderstorms, radios and electrical noise (including adjacent copper wiring carrying other signals, e.g., “crosstalk”), not to mention signal attenuation as distances increase between DSLAM and subscriber. The condition and gauge of the copper wire carrying the signal also matters.

When it comes to head-to-head competition with DOCSIS, DSL loses. As AT&T Randall Stephson told the National Association of Regulatory Utility Commissioners (NARUC) back in 2011, ADSL is “obsolete.” But many in the hinterland are still stuck with substandard DSL service—which is why fixed wireless has grown in popularity in recent years.

For a list of all American DSL Internet providers, see this.

3. Satellite

Previously, the IAG has spent considerable space hashing out satellite Internet and the two American sat ISPs, HughesNet and Viasat. Readers may question why we prefer sat ISP over mobile LTE yet rate it below DSL.

Consider these four factors: latency, data speeds, monthly cost and data caps.

Latency

Sat ISPs will always have the worst latency of any Internet access technology; it’s a matter of physics. From your device to destination web URL and back could easily encompass 100,000 miles or more. Radio waves can travel only so fast.

Data Speeds

No doubt, sat ISPs have upped their data speeds considerably in recent years. HughesNet delivers up to 25 Mbps, the current definition of broadband in the U.S. While Viasat offers 12 Mbps or 30 Mbps in most areas, some lucky few locales can allegedly receive speeds as fast as 100 Mbps. Meanwhile, legacy DSL in the outback is lucky to hit 10 Mbps.

It’s much easier to peg the speeds of the two sat ISPs as opposed to DSL speeds offered by hundreds of telcos, especially when factoring DSL loop distance and wire plant condition. ADSL2+, the technology most deployed by ILECs, is slower than HughesNet and subscribers will be lucky to find their DSL speeds on a par with the slowest speeds offered by Viasat. Still, DSL usually costs considerably less.

Monthly Cost and Data Caps

Regardless of region, a subscriber’s monthly cost is firmly established with HughesNet; subscribers will pay either $60, $70, $100 or $200 based on data allowance. Viasat is more opaque in this regard but as a rule, subscribers can expect to spend between $70 to $200 per month based on speeds and data caps. While DSL speeds may pale by comparison with sat ISPs, DSL subscribers generally receive more generous data allotments (if allotted at all) at a cheaper price.

If your farmhouse is too far from the nearest telco DSLAM, and your DSL service dribbles data speeds that fluctuate between 8 to 5 to 3 Mbps, a sat ISP may be a better choice. Much depends upon how one uses the Internet. Keep in mind if you’re a sat ISP subscriber and stream lots of data, you’ll quickly blow through your data cap and pay dearly for extra GBs. Also, your choices of online gaming will be severely restricted when using a sat ISP.

4. Mobile Wireless—4G LTE

If we’re so gung-ho on fixed LTE wireless, why would we place mobile LTE so far down the list? The answer: cost and restrictive data allowances.

While users can expect 10 Mbps speeds or faster over their mobile LTE networks, note the severe data cap restrictions most carriers aka mobile network operators (MNOs) and hosted providers (MVNOs) place on subscribers. Once a data cap is breached, a user’s device is relegated to talk and text until the next billing cycle. You won’t go very far or very fast when your device’s data speeds are throttled back to 128 Kbps (as with AT&T Wireless).

MNO data allowances are pricey and restrictive. For example, AT&T’s “Unlimited” mobile plan costs $85/month ($70/month with auto-billing) with a data allowance of 22 GB per month. Once this threshold is reached, “AT&T may temporarily slow data speeds during times of network congestion” until the next billing cycle. Read: your data speeds will be throttled.

Verizon’s mobile plans are more forgiving in terms of data allowances but still, they’re not cheap. The “Get More Unlimited” plan for $90/month gives subscribers 75 GB of data before Big Red throttles their data stream. For $80/month, the “Do More Unlimited” plan offers 50 GB of data before Verizon chokes the data spigot.

Mobile Wireless—3G

While HSPA+ (“3.5G”; before the advent of true LTE, deviously marketed as “4G” by MNOs) theoretically delivers up to 42 Mbps down and 22 Mbps up, don’t expect to receive those speeds in “the real world.”

In July 2019, Open Signal reported these 3G download speeds from the 4 major MNOs:

-

T-Mobile—4.2 Mbps

-

AT&T—3.3 Mbps

-

Sprint—1.3 Mbps

-

Verizon—.9 Mbps (900 Kbps)

As readers will duly note, mobile carrier data allowances are more repressive than those of virtually any other Internet provider, save for the lower data tiers of sat ISPs and a few WISPs. While millions of Americans use their mobile devices exclusively to access the Internet, it’s hardly an optimal online experience.

5. Dialup

Fun facts: in 2017, 2.1 million Americans still used AOL dialup to surf the net. In November 2017, over 1% of households in 12 American states accessed the Internet via dialup. Alabama led the nation at 4.07%. As of July 2018, 9 million Americans still used dialup Internet.

According to the FCC’s 2019 Broadband Deployment Report, “21.3 million Americans at the end of 2017” lacked access to broadband. While “the number of rural Americans with access to such broadband increased by 85.1% in 2017,” the FCC fails to mention that this increase is due to advanced data speeds from sat ISPs—not from Internet providers delivering fiber or DOCSIS technologies.

We’ve made the point that POTS was designed for voice traffic. It uses bandwidth spanning the range of the human voice—approximately 3,000 Hz—and this bandwidth allocation can’t transport much data. Hence, telephone voice-grade channels are called “narrowband.” Consider: one gigabyte of data requires around 40 hours to download across a 56 Kbps voice channel. But it’s only 7 minutes of an HD video.

Back in the ’90s, web users relied on 28.8 Kbps and 33 Kbps modems. A voice channel at best transports only 56 Kbps; 40 Kbps is more the norm. When 56 Kbps modems arrived, they were greeted as conquering heroes. But today, a 56 Kbps modem is all but useless. Given the number of scripts now embedded in today’s web pages, many sites won’t load over a dialup connection—it takes too long and eventually the website times out.

Many dialup ISPs use data compression to increase perceived download speeds. This results in a loss of image quality. But they can’t compress video or audio streams or secure web pages, viz, URLs with “https.” Dialup is good for email but not much else.

Coda

Actually, it’s not difficult at all to imagine a dystopia where nobody has DOCSIS (cable) to access the web. In 2019, only 4.5 billion people worldwide—less than 60% of the planet’s 7.7 billion inhabitants—have access of any kind to the Internet. Americans speak of the “digital divide” between rural and populated portions of the nation but the information gulf is more pronounced around the world.

Yet DOCSIS apparently will not be the technology to bring Internet to the masses. Mobile wireless communications, either 4G LTE or 5G, will be the ticket. Cybersecurity Ventures foresees that by 2022, 6 billion will use the Internet, or ¾ of the world’s projected population. By 2030, Internet users will increase to 7.5 billion, or 90% of the world’s projected population.

It’s much cheaper to build out wireless infrastructure than to wire individual residences.

The World Advertising Research Center (WARC) predicts that by 2025, 72.6% (or 3.7 billion) of web users will access the Internet exclusively via smartphones. Just 69 million users will use only a PC to go online. Be prepared for the coming dystopia where a hard-wired connection to the Internet will be hard to find.